From Tariffs to Inflation: How Prices Sneak Up on You

Inflation, Tariffs, and the Rising Price of… T-Shirts?

Welcome back to the Pink Money Podcast, where we talk about money from a queer perspective. Today we’re tackling something that affects every single one of us: inflation and tariffs.

Prices naturally rise over time, but lately it feels like they’re climbing faster than usual. Why does this happen — and what can you do about it?

A Simple T-Shirt Example

Let’s make it real with a T-shirt business.

-

At first, I buy 3 shirts wholesale for $10 and sell them at $20 each. That’s a $50 profit.

-

Then the wholesaler raises prices to $13. To keep my margin, I raise my price to $21.

-

Next, a 50% tariff hits the fabric distributor. That cost passes down the chain: distributor → wholesaler → me → customers. Now shirts cost about $23 each.

That’s inflation and tariffs in action. Costs don’t just sit on a balance sheet — they roll downhill until consumers (you and me) pay the difference.

A Historical Lesson: Weimar Germany

For the extreme version, look to Weimar Germany in the early 1920s.

-

1918: a loaf of bread cost 0.5 marks.

-

1921: 4 marks.

-

1922: 163 marks.

-

Aug 1923: 69,000 marks.

-

Oct 1923: 1.7 billion marks.

-

Nov 1923: 201 billion marks.

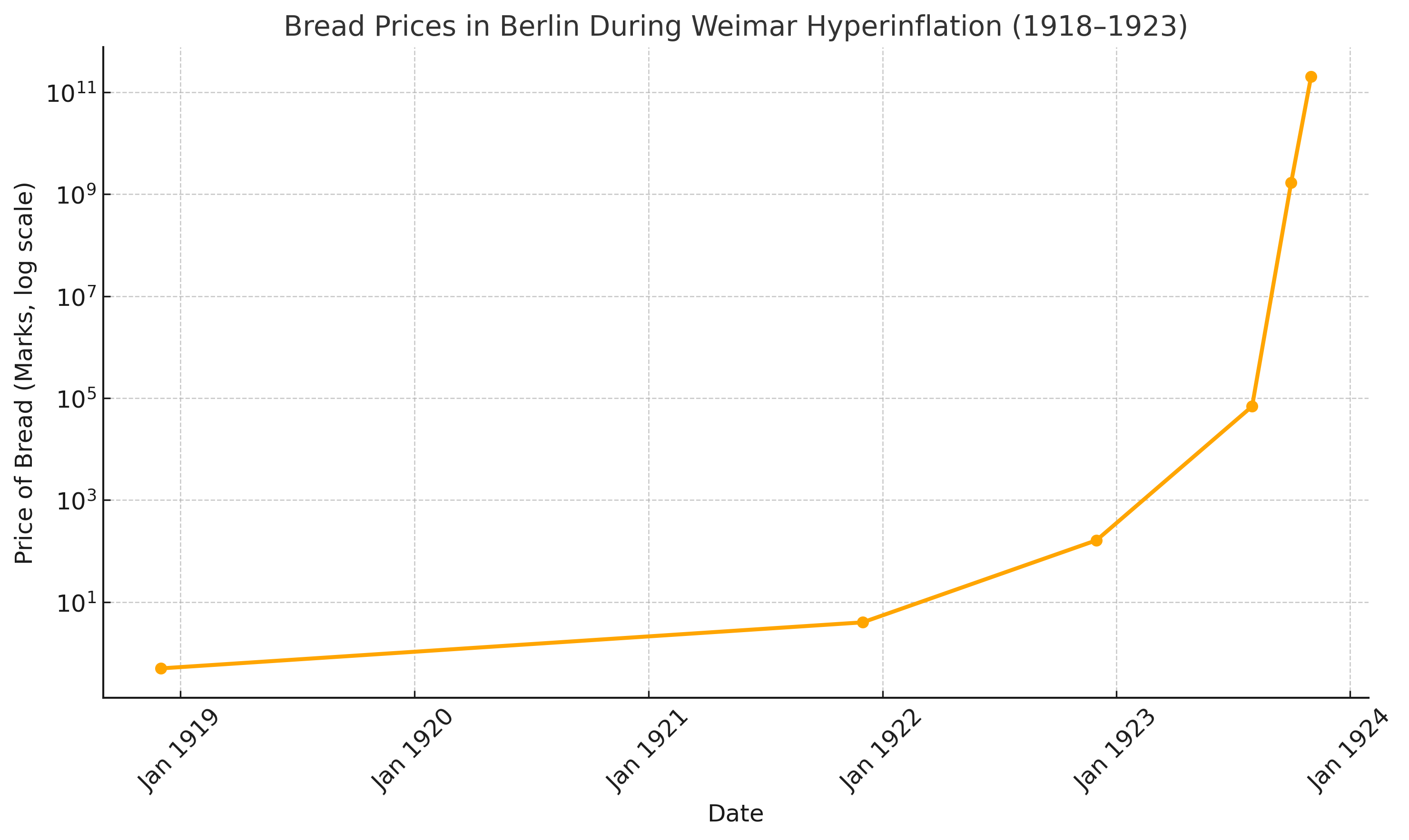

📊 Historical Snapshot

Here’s a striking chart of Berlin bread prices during hyperinflation:

What it shows: when inflation spirals out of control, savings are destroyed, bartering replaces cash, and trust in money evaporates. Families literally wallpapered their homes with banknotes because it was cheaper than buying paper.

Why This Matters Today

No, we’re not in Weimar Germany. But rising prices and global tariffs are real pressures now. Businesses can only absorb so much before passing costs along, which means we feel it directly at the grocery store, the gas pump, and even in the price of a plain T-shirt.

What You Can Do

You can’t control tariffs or government policy — but you can protect yourself financially. Start here:

✅ Build an emergency fund (3–6 months of expenses).

✅ Pay down high-interest debt (that 19% credit card eats your future).

✅ Be smart with big purchases (cars lose value fast — buy what you need, not what looks flashy).

✅ Boost your income (side hustle, roommate, or monetizing a hobby = breathing room).

Think of these as your personal defense moves against rising costs.

Final Thoughts Inflation and tariffs may be out of your control, but your financial priorities are not. Protect yourself, pay yourself first, and don’t be afraid to make hard choices today to build stability tomorrow.📌 Want to dive deeper? The full transcript and bonus notes are posted at www.pinkmoneypodcast.com

Thanks for listening — and reading. Until next time: stay informed, stay prepared, and keep control of your money.

Designed to Educate, Enlighten, and Empower the LGBTQ+