🏠 Head of Household: King of the Castle or Outdated Relic?

Why “Head of Household” is Stuck in 1969 — And Why It Needs to Change

We all like to think of ourselves as “king of the castle.” You’re paying bills, running the show, keeping the lights on. So when you hear Head of Household, it feels like it ought to be you, right?

Well… probably not.

The IRS doesn’t care how you feel. They don’t see you as the one holding your family together. To them, you’re just a taxpayer. Do you meet their narrow rules or not? It’s cut and dry: 50% support, majority of the year living with you. Yes or no.

And here’s the kicker: only about 1 in 5 taxpayers actually qualify for Head of Household.

👨👩👧 Families Aren’t 1969 Anymore

The problem isn’t us. It’s the rules.

When HOH was created, the world looked different: dad, mom, two kids, a dog, and a white picket fence. But families today are blended, chosen, and beautifully messy:

-

Two married wives could each be running a household.

-

A straight couple “shacking up” might not be legally married but still raise kids together.

-

A gay couple could be raising their niece or nephew.

-

Some parents are sandwiched between kids from an ex and grandparents they support.

-

Chosen families are everywhere — the neighbor’s kid who calls you “mom and dad,” the grandparents you’ve moved in to care for, the friend who’s become your sibling in every way that matters.

The IRS doesn’t care about any of that. It wants its square pegs in square holes. If you don’t fit, too bad.

🤔 So What Are You Left With?

If you don’t qualify for HOH, you’re stuck with:

-

Single

-

Married Filing Jointly

-

Married Filing Separately

That’s it. Like it or lump it.

Sure, the standard deduction has gotten larger and itemizing has mostly become irrelevant for most people. But that doesn’t change the bigger issue: as families evolve, the tax code hasn’t.

🚨 The Reality Check

Philosophy aside, here’s the truth: if you use HOH, you better know the rules.

HOH is one of the most commonly abused or misunderstood statuses on tax returns. Sometimes the abuse is deliberate, but often it’s just people thinking they qualify when they don’t — for example, separated couples still living under the same roof, or taxpayers supporting relatives who don’t meet the IRS definition of a “qualifying person.”

This misuse is exactly why the IRS scrutinizes HOH filings so closely.

🛑 The Compliance Burden

For taxpayers: HOH isn’t about how your situation feels. It’s about strict IRS tests. If you file incorrectly, you risk audits, delays, and lost refunds.

For preparers: the stakes are even higher.

-

Every paid preparer must file Form 8867 (Paid Preparer’s Due Diligence Checklist) if HOH is claimed.

-

They must ask probing questions, gather documentation, and keep records.

-

If they fail, they face a $600 penalty per failure (2025). And each issue is counted separately — meaning one return can rack up multiple penalties.

So don’t expect your preparer to just “take your word for it.” They’re required to prove it. If they don’t, it’s their money on the line — not yours.

📊 The IRS’s Black-and-White Rules

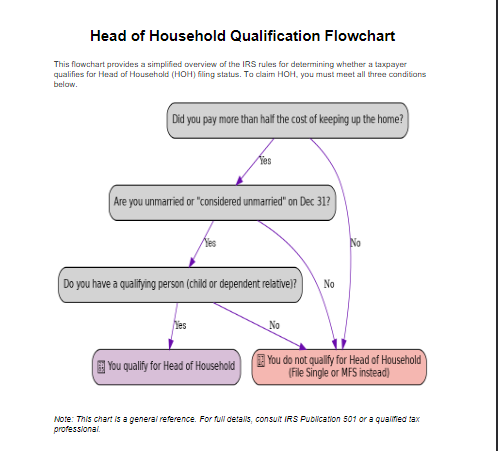

*This flowcart is a simplified visual guide to the IRS's Head of Household rules.*

The path to HOH is simple on paper:

-

Pay more than half the cost of keeping up the home.

-

Be unmarried (or “considered unmarried”) on Dec. 31.

-

Have a qualifying person who lived with you more than half the year.

Miss one? Sorry — no HOH.

🔑 The Takeaway

HOH raises a fair debate: in a modern world, does it still reflect how households truly work? Maybe. Maybe not.

But here’s what isn’t up for debate:

-

If you qualify, HOH can save you thousands.

-

If you don’t, and you try to claim it anyway, the IRS will eventually find out.

So if you’re going to use HOH, know the rules, document your eligibility, and don’t take shortcuts. Otherwise, what feels like a tax break today could turn into regret tomorrow.

Families are not what they were in 1969. They are more diverse, more complex, and more real than ever before. And the tax code should reflect that.

More people should qualify for Head of Household. Period.

Until then, the rules remain outdated, stuck in the past — and out of touch with how Americans actually live.

✍️ Pink Money Podcast

✨ Enlighten. Empower. Educate with Pride. 🌈